Can Yahoo Gemini Succeed In Search? SEM Execs Weigh In

Yahoo's foray back into search advertising faces a mountain of challenges, from volume to functionality. Industry executives share their thoughts on Gemini’s trials, promise and future.

When Yahoo debuted Gemini in Feburary 2014, it signaled CEO Marissa Mayer’s drive to make Yahoo a player in search again — with mobile as the way in. A marketplace that couples search with one of the hottest growth areas in digital — native — is a major piece of Mayer’s turnaround plan.

But getting agencies and marketers to invest in and commit resources to a nascent platform is easier said than done — just ask Microsoft. After six years, Bing just became profitable this past quarter.

Can Gemini give Yahoo a foothold back into search advertising? Marketing Land spoke with several industry executives to get their take on Gemini’s promise, challenges and future.

Yahoo And Bing: The Current Status

First, a quick recap of where the Microsoft-Yahoo agreement puts Gemini now. With the renegotiated deal in May, Yahoo may continue to serve ads on up to 100 percent of Yahoo mobile search traffic, and now up to 49 percent of Yahoo desktop search traffic. The new deal also means separate sales forces from Yahoo and Microsoft can work with premium advertisers separately.

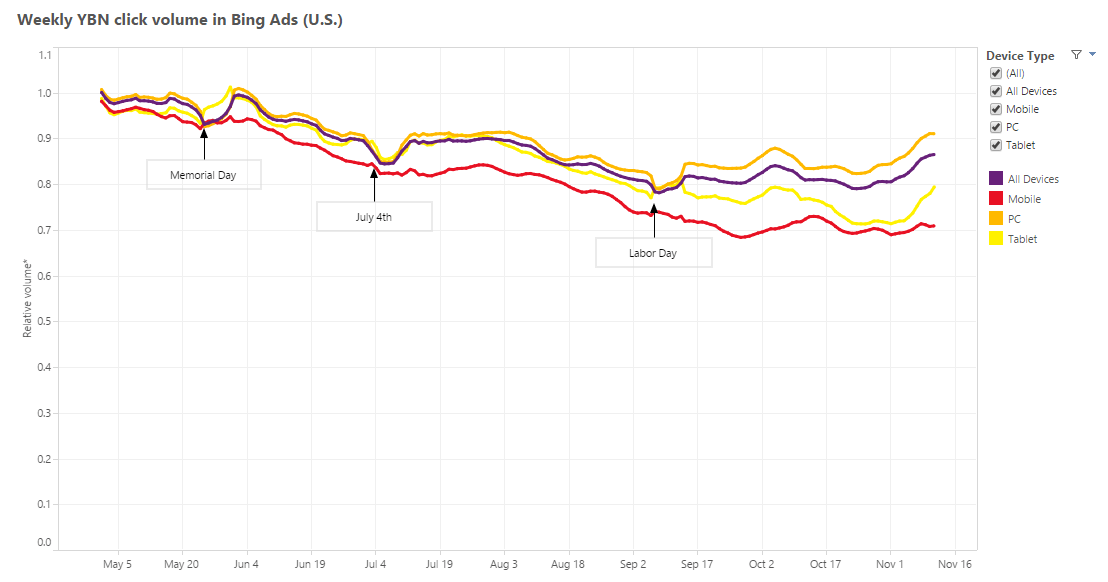

Yahoo has been shifting mobile and desktop ad serving to Gemini and experimenting with optimization and monetization. Microsoft, however, says the majority of Yahoo search impressions continue to be served by Bing Ads, and releases a weekly update on click volume. Mobile click volume on the Yahoo Bing Network (YBN) was at 71 percent for mobile and 87 percent overall the week of November 10, according to Microsoft’s status update.

And Now Google?

Then there’s the Google development.

On Yahoo’s third-quarter earnings call, Mayer announced a three-year search advertising partnership with Google. If approved by regulators, Yahoo could start fulfilling desktop and mobile inventory with ads booked through Google AdWords or Bing Ads or Yahoo Gemini.

Yahoo’s stock ticked up on the news that it was hitching its search wagon to Google’s monetization engine. Meanwhile, many marketers were scratching their heads about what the partnership signals for Yahoo’s long-term intentions despite Mayer’s strident assurances that Yahoo is still fully committed to Gemini.

With Google and Bing backfill, will marketers need to manage search campaigns in Gemini directly at all?

Market Confusion

The Google agreement should presumably allow Yahoo to hedge its bets as it continues to optimize Gemini. As Jason Hartley, VP, US Search Practice Lead at 360i, puts it, the Google deal could help keep Yahoo in the best shape monetarily while it tries to make Gemini work.

The danger is that the deal (if approved) could cause more advertisers to sit on the sidelines, satisfied to have Yahoo inventory fulfilled by their Bing Ads and AdWords campaigns.

“There was already a degree of uncertainty among advertisers about the value of managing Gemini ads when Yahoo is still serving Bing Ads,” says Mark Ballard, Senior Director of Research at Merkle RKG and Search Engine Land columnist, who wrote about Gemini’s performance in his latest column. “If the Yahoo and Google agreement gets approved it will only raise more questions about the need to manage Gemini separately, particularly if Google’s ads deliver strong results.”

The Google deal “could confuse things,” agrees Hartley, adding that it’s reminiscent of AOL’s deal with Google, when agencies did some deals with AOL because they had brand offerings that Google did not, but mostly relied on Google backfill.

Caitlin Halpert, Account Director at 3Q Digital, put this line of thinking in more dire terms: “If the Google/Yahoo Agreement is approved, the Gemini platform will die, at least on the search side.”

Why the blunt prediction? “Gemini adoption has been slow due to low market share, poor platform usability, and limited integration with bid management platforms,” says Halpert. “If even a portion of the inventory is available via Google the additional time investment to manage a third engine will have an even lower ROI for many advertisers. For Gemini to save itself Yahoo has to gain market share.”

Low Volume Challenges & Limited Features

Low volume and limited functionality are, not surprisingly, common threads in most marketers’ comments on Gemini. A lack of inventory and platform features is likely to be a recurring sound-off about the nascent platform, just as Bing Ads experienced for years.

“It’s not clear that Gemini adopters are seeing much, if any incremental traffic and there is a lot of overhead that goes into managing a new platform,” says Ballard.

He added that many clients felt that it was worth adopting Gemini in the hopes of gaining incremental traffic and conversions, but that the move was also defensive, in case Yahoo made sudden drops in volume served by Bing Ads. “Still, we find that Yahoo accounts for about 10 percent of the US search market, so it faces an uphill battle in getting attention and priority from advertisers.”

Dave Ragals, Global Managing Director of Search at IgnitionOne adds that impression volume has become a challenge across search engines. “Search is certainly experiencing some inventory constraints as impressions are dropping for the major search engines, so certainly opening up Yahoo has some appeal to advertisers who are maxing out elsewhere. Since the scale of Gemini traffic is still very small, it may keep potential marketers away as the effort of capturing that traffic is still significant.”

On The Plus Side

Despite these challenges, marketers also had positive things to say about Gemini. Some have seen strong results from the platform, and there is also a hope that more competition will bring more innovation and opportunities for brands and marketers.

“We believe that a healthy Yahoo is good for the industry and good for clients,” said Hartley. A digital marketplace that’s not wholly dominated by two players – namely Google and Facebook — will ultimately create more opportunities for brands, the thinking goes.

Benefits Seen Beyond Brand

Many agencies and marketers say they have limited their search efforts in Gemini to brand campaigns. They can defend brand terms on Yahoo traffic without devoting a lot of effort to maintenance work.

That said, Ragals adds that clients who have moved beyond running just brand terms are seeing positive results on Gemini. “Our clients primarily began using it for brand search but saw very low traffic. Adding in non-brand has so far significantly lifted volume while producing greater efficiency than other engines.”

A Separate Bing Ads And Yahoo Has “Energized Both”

What does Gemini mean for Bing Ads?

Hartley says that separating Yahoo and Bing sales teams has changed the dynamics. “The most palpable thing is that it seems to have energized both camps,” says Hartley. Bing and Yahoo have both been beefing up their outreach to agencies, and Hartley expects to see more innovation and experimentation coming from both engines.

What Yahoo has now that it didn’t before is a search innovation laboratory and the ability to try new ad formats on its own. “Some of the units we’ve seen are desktop focused and make good use of the added real estate,” Hartley pointed out.

The freedom to experiment could help make Yahoo traffic indispensable for advertisers, but getting there won’t be easy.

“If Gemini can clearly deliver some combination of increased volume and increased conversions over the ads Bing serves on Yahoo, then most large advertisers will have to find the resources to put towards managing a Gemini program,” says Ballard. “That is easier said than done though, as Bing has really improved how well they monetize search traffic in the last few years and Yahoo is still just getting back into the game.”

Flurry Data On Mobile Users

Yahoo has an advantage in Flurry, the in-app ad network and app analytics company that Yahoo acquired in July 2014. This is where the native ads side of Gemini comes in, but there may also be synergies with search.

As Ragals points out, Yahoo’s mobile search inventory alone is probably not a big enough draw for many advertisers. “But the integration with Flurry and all of the data that this gives them is a very interesting proposition. Yahoo have previously stated that this link provides them with insight into 1.8 billion portable devices globally and 52 percent of all apps plug into it.”

If Yahoo coupled the Flurry data and Yahoo’s own user data with mobile search intent, it could be very interesting indeed. Whether that will happen remains to be seen. For now, search is separated from that data source.

This goes to another point on functionality and features. Last month, Yahoo launched custom audience retargeting capabilities for native ad campaigns in the same week Google announced Customer Match, which lets advertisers target customers on Google search, Gmail and YouTube via customer email addresses. Yahoo’s capability is more limited.

“With respect [to] the custom audience capabilities that Yahoo is rolling out, it’s a step in the right direction, but in its current iteration falls short as it only allows for retargeting by matching mobile device IDs rather than email addresses,” says Stephen Gelber, Director of Media Buying at Fluent. “This limits the scalability of its custom audiences offering relative to competitors like Facebook and Google.”

More Promise Seen On The Native Ads Side

Brad O’Brien, Director of Social at 3Q Digital, works with native campaigns in Gemini. He says from the native ads perspective, “there’s still some viability in publisher exclusivity through Gemini. For instance, one of our many FinTech clients may have interest in running native ads in Yahoo Finance. It’s the same reason why some advertisers would work with both Taboola and Outbrain — to sure up inventory on certain publishers.”

“The native offering has some neat integrations when compared to content networks like Taboola. Keyword targeting and competitor domain targeting most notably,” O’Brien adds, yet, “On the native side, we’ve seen achieving any sort of scale a challenge as well. Part of this is levers and the other is that audience pools can sometimes struggle to populate.”

A Path To Long-Term Viability

Yahoo executives mentioned Gemini 37 times on the third-quarter earnings call. The company says it is committed to a long-term investment in the platform and in mobile search. It’s also clear, though, that this is very early days and advertisers who are trying Gemini now are in fact part of the testing process.

“Mobile search continues to be a critical area of investment for us,” said Mayer. “And one of the key ways we are investing is by moving additional traffic and advertisers to the Gemini platform in order to fully optimize and train our ad system. Overall, we remain optimistic about growth opportunities in search.”

Agencies say they’ll be more likely to go along for the ride if they start seeing Yahoo Gemini pushing the envelope, experimenting and providing an offering that is different from Google and Bing.

For the market to embrace Gemini, “Yahoo needs to… go down the Bing approach of making it very easy to manage alongside Google; all of the features match up so that it is easy to clone a Google campaign and push it to Bing with comparable features,” says Tom Manning, Head of Paid Media at Forward3D. “Alternatively, Yahoo needs to make it something different and unique that advertisers will clamor to use. This is actually the direction that I think they are trying to pursue with the very specific mobile-first focus of Gemini.”

Hartley is also looking to Gemini for a different experience and more opportunities for clients. “I hope they make it useful and differentiated because Google doesn’t suit all of our needs.” Spirits brands, for one, are very limited in what they can do on Google due to Google’s own restrictions. Yahoo could offer more opportunities.

For Yahoo Gemini to have a chance, “They need to commit to it,” says Ragals. “They say it every day, but they’ll really need to keep some big brains on it to increase traffic and drive performance as well as upgrade both the UI and API. To do this will also take working very closely with platforms and other third parties to help drive adoption.”

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land